Business

Access Holdings to raise staggering N365 billion in right issue

Access Holdings to raise staggering N365 billion in right issue

Access Holdings, one of Nigeria’s largest financial institutions, has announced plans to raise a staggering N365 billion (Three Hundred and Sixty-Five Billion Naira) through a rights issue.

The company is also seeking a combined capital raise of up to $1.5 billion via equity, quasi-equity, and debt issuances.

This strategic move is expected to fortify the bank’s capital base, supporting its continued expansion and its ability to seize emerging opportunities in the financial sector.

The details of this planned capital raise were made public in a notice about an upcoming Annual General Meeting, which was disseminated via the Nigerian Exchange Group (NGX).

Rights Issue Details

As part of this monumental rights issue, Access Holdings (aka Access Corporation) will see an expansion in its issued share capital from N17,772,612,811.00 , divided into 35,545,225,622 ordinary shares, to N26,658,919,216.50.

This expansion is facilitated by the creation of an additional 17,772,612,811.00 ordinary shares, each priced at N0.50 Kobo, which will rank pari-passu with the existing shares of the company.

The capital raise of N365 billion through a rights issue is set to occur on dates and under terms specified by the Directors, subsequent to obtaining approvals from relevant regulatory bodies.

This strategic financial maneuver is anticipated to assist Access Corporation in more effectively navigating the competitive landscape of the banking industry, with an enhanced ability to invest in technology, infrastructure, and human capital.

It also positions them advantageously ahead of an imminent announcement by the central bank to increase bank share capital to approximately N500 billion.

Board’s also seeking to raise $1.5 billion

Moreover, the Board of Directors is also seeking the authority to embark on a capital raising programme of up to US$1,500,000,000.00 (One Billion, Five Hundred Million United States Dollars) or its equivalent.

This programme may involve the issuance of ordinary shares, preference shares, Alternative Tier 1, convertible and/or non-convertible notes, bonds, or any other instruments.

The offerings could be conducted through a public offering, private placement, rights issue, book building process, or any combination thereof, subject to necessary regulatory approvals. T

he details regarding the tranches, series, proportions, dates, rates, maturity periods, and terms and conditions will be determined by the Board.

What this means

Access Holdings, following the announcement of its fiscal year 2023 results, has disclosed a total share capital of approximately N2.1 trillion. Within this share capital, retained earnings amount to about N715 billion, alongside “other components of equity” totaling around N936.7 billion.

The company is poised to embark on a capital raise that constitutes about 17% of its total share capital, a figure that notably exceeds its current share capital and premium, which stands at N251.8 billion.

In the wake of these developments, the company’s share price saw an uptick, closing at N24 on Wednesday, reflecting a 3.9% increase.

This rise comes in the aftermath of Access Holdings announcing a profit after tax of N612.4 billion for the year ended 2023.

Access Holdings, with its subsidiaries spread across various African nations, continues to strategically focus on inorganic acquisitions as a pivotal component of its growth strategy.

This approach to raise capital highlights the company’s ambition to expand its footprint and enhance its market presence across the continent, leveraging acquisitions to fuel its growth ambitions effectively.

Business

Diaspora Nigerians to Obtain BVN by Year-End- Cardoso

Naijanewsngr- Nigerians living in the diaspora will soon have the opportunity to acquire Bank Verification Numbers (BVN) before the end of the year, according to Yemi Cardoso, the Governor of the Central Bank of Nigeria (CBN).

During a meeting with the Nigerian community in Washington, D.C., Cardoso announced that the initiative will be managed by the Nigerian Inter-Bank Settlement System (NIBSS). He emphasized that the BVN project will not only improve financial inclusion for diaspora Nigerians but will also bolster remittances sent back home. This strategic move aligns with the CBN’s broader goal of enhancing financial services for Nigerians globally, making it easier for them to maintain financial ties with Nigeria.

In his address, Cardoso stated, “As far as we are concerned, it is totally unacceptable that you should be out here and be having hassles in operating your accounts or doing business in your original country.” His remarks underscored the importance of ensuring that diaspora Nigerians can access and operate their Nigerian accounts without undue complications.

This initiative is expected to significantly impact diaspora remittances, a major source of foreign exchange for Nigeria. With a streamlined process in place, Nigerians abroad will be able to remit funds more easily, contributing to the nation’s economy. The BVN registration will allow for more secure and efficient financial transactions, while also opening doors for diaspora Nigerians to invest more actively in Nigeria.

In a separate meeting with international investors, Cardoso discussed the recent monetary policy reforms in Nigeria. He urged investors to explore the opportunities within the Nigerian market, highlighting the favorable economic climate for foreign investment. This call to action aims to attract international capital into the country, further driving economic growth.

By rolling out the BVN to Nigerians abroad, the CBN seeks to ensure that all citizens, regardless of location, can engage meaningfully with Nigeria’s financial system, strengthening the overall economy.

Business

Abbey Mortgage Bank Excites Customers with Abuja Roadshow

Naijanewsngr– Abbey Mortgage Bank, a leading institution in the mortgage sector, has made significant strides with its groundbreaking roadshow tagged “Abbey Sales Storm” held at the Federal Capital Territory (FCT), Abuja.

The “Abbey Sales Storm” is aimed at bringing the financial and real estate opportunities to residents of the Federal Capital Territory and sharing valuable information on how it can be achieved with the Abbey Mortgage Banking investment.

The exciting roadshow which kicked off on Thursday, October 17, 2024 made stops at different locations in Abuja including popular spots like UTC and Barnex with Sales reps and activation agents distributing flyers and engaging with prospective clients about its products and service offerings.

Speaking during the roadshow organized by the bank, The Group Head of Retail Sales and E-Business, Abbey Mortgage Bank, Felix Omodayo-Owotuga, noted that “It was a good turnout. We’re thrilled to have finally made a buzz here in Abuja. Our goal is to bring greater awareness to what Abbey has to offer, and today’s roadshow is a big step in that direction.”

Owotuga further noted;

“Abbey Mortgage Bank has a strong presence in Abuja, with branches in key locations including Baze University and Area 11, making it easier for residents to access their trusted mortgage and financial services.

“Abbey continues to lead the industry as an innovator in the Nigerian mortgage sector, not just offering mortgage services but also retail & investment banking solutions, positioning itself as a one-stop-shop for all domestic banking needs.” He added.

Abbey Mortgage Bank recently celebrated the annual Customer Service Week, with daily themed dress codes; ranging from dressing in attires to highlight the bank’s signature corporate navy blue colour, to a fun day in which staff ‘twinned’ outfits and Abbey-branded T-shirts. These activities underscore Abbey’s commitment not only to excellent customer service but also to fostering a positive and engaging work environment.

As Abbey continues to expand its footprint in the Nigerian finance sector, the bank remains dedicated to offering top-tier services in the mortgage space and beyond.

Business

Access Holdings Plc Extend Rights Issue Acceptance Period To August 23, 2024

Access Holdings Plc Extend Rights Issue Acceptance Period To August 23, 2024…

Access Holdings Plc (“the Group”) has announced an extension of the acceptance period for its ongoing Rights Issue. Initially set to close on August 14, 2024, the period has now been extended to August 23, 2024, following the approval of the Securities & Exchange Commission (SEC).

The statement, signed by the Group’s Company Secretary, Sunday Ekwochi, confirmed that, “The decision is in response to the recent nationwide protest that disrupted operations of businesses and individuals across Nigeria and to provide shareholders with ample opportunity to subscribe to their rights.

“During the extended period of the Issue, dealings by the Company’s insiders on the Company’s shares will continue to be strictly limited to participation in the Rights Issue as earlier approved by the Exchange in respect of the Non-Dealing Period on the Company’s Audited Interim Financial Statements for the Period Ended June 30, 2024, until 24 hours after the publication of the Interim Financial Statements.”

For further inquiries or additional information regarding the Rights Issue, shareholders and prospective investors are encouraged to contact Access Holdings’ Investor Relations team at Investor.Relations@theaccesscorporation.com.

Access Holdings Plc

Access Holdings Plc is a leading multinational financial services group that offers commercial banking, lending, payment, insurance, and asset management services. Headquartered in Lagos, Nigeria, Access Holdings operates through a network of more than 700 branches and service outlets, spanning three continents, 22 countries, and 60+ million customers.

Access transitioned into a holding company to drive rapid growth and become a full-scale ecosystem player offering interconnected services across customer needs. Established in 2022, Access Holdings Plc consists of the Access Bank Group; Access Pensions; a Payment and Switching Services Company; a Digital Lending Company, and an Insurance Brokerage Company.

The banking vertical serves its various markets through four business segments: Retail, Business, Commercial and Corporate, and has enjoyed what is it arguably Africa’s most successful banking growth trajectory in the last eighteen years, becoming one of Africa’s largest retail banks by customer base and Sub-Saharan Africa’s largest bank by total assets.

Access Holdings strives to deliver sustainable economic growth that is profitable, environmentally responsible, and socially relevant, helping customers to access more and achieve their dreams.

-

News2 years ago

News2 years agoWhat Led Us To Choose Peter Obi As Our Candidate?-Middlebelt Forum

-

Entertainment1 year ago

Entertainment1 year agoTaylor Swift Skips Travis Kelce’s Big Game to Prepare for ‘Eras Tour’

-

BREAKING NEWS1 year ago

BREAKING NEWS1 year agoKey Insights for the Upcoming 2023/2024 UEFA Champions League Campaign

-

News10 months ago

News10 months agoPaul Agbonze Obazele Addresses Labor Party Leaders in Edo Central Senatorial District

-

BREAKING NEWS1 year ago

BREAKING NEWS1 year agoVan Gaal Alleges 2022 World Cup Rigged in Favor of Messi and Argentina

-

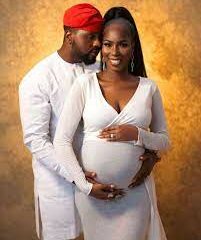

Entertainment1 year ago

Entertainment1 year agoAdebola Williams and Kehinde: Welcoming Baby Arinoluwa

-

BREAKING NEWS12 months ago

BREAKING NEWS12 months agoBarcelona Triumphs in Women’s Champions League Opener as Oshoala Shines Despite Saudi Visa Cancellation

-

News2 years ago

News2 years ago“New King of Serie A,” Tinubu hails Osimhen on winning the Serie A Title