Business

10 Reasons Fidelity Bank is Unshakable in 2025

Naijanewsngr– Fidelity Bank Plc has continued to solidify its reputation as one of Nigeria’s most resilient and forward-moving financial institutions.

With consistent growth in key financial metrics, the bank’s performance in recent years—particularly in 2024 and the first quarter of 2025—has showcased its strategic foresight, operational efficiency, and unwavering commitment to shareholder value.

Backed by a robust capital structure and strong governance, Fidelity Bank has effectively positioned itself among Nigeria’s top-tier banks, balancing aggressive growth with prudent risk management. The bank’s strategic focus on innovation, customer-centric solutions, and enhanced service delivery has yielded outstanding results.

From exceptional profit growth and significant deposit mobilization to prestigious international recognition, Fidelity Bank’s 2025 trajectory reflects not just strong financials but a solid foundation built for long-term sustainability.

Here are the 10 highlights of Fidelity Bank Plc’s strength and solidity in 2025:

Record Dividend Payout

In 2025, Fidelity Bank declared a total dividend of ₦2.10 per share, translating to ₦89.95 billion paid to shareholders for the 2024 financial year—the highest in the bank’s history. This reflects its strong earnings performance and underscores its commitment to rewarding shareholder loyalty with generous and consistent returns.

Exceptional Profit Growth

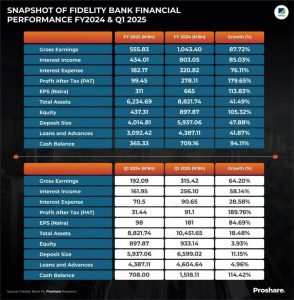

The bank posted a remarkable 210% year-on-year increase in Profit Before Tax (PBT), rising from ₦124.2 billion in 2023 to ₦385.2 billion in 2024. This unprecedented growth was driven by strong revenue performance, improved cost management, and effective execution of its strategic growth plan.

Robust Q1 2025 Performance

Fidelity Bank started 2025 on a strong note, reporting ₦105.8 billion in PBT in the first quarter alone, up 167.8% from ₦39.5 billion in Q1 2024. This reflects sustained momentum in earnings growth, supported by rising income from both core banking and non-interest revenue streams.

Significant Gross Earnings Increase

The bank’s gross earnings surged by 64.2% year-on-year, reaching ₦315.4 billion in Q1 2025, compared to ₦192 billion in Q1 2024. This impressive performance was driven by increased interest income, robust fee-based income, and gains from foreign exchange transactions.

Strong Deposit Base

Fidelity Bank’s total customer deposits hit a record high of ₦6.6 trillion, representing a major vote of confidence from customers. Notably, foreign currency deposits grew by 21.4%, reflecting the bank’s strong offshore inflows and trust among corporate and high-net-worth clients.

Tier 1 Capital Strength

The bank maintained its designation as a Tier 1 bank in Nigeria, highlighting its robust capital adequacy, asset quality, and operational resilience. This categorization places Fidelity among the elite banks with the capacity to support large-scale transactions and withstand macroeconomic shocks.

Market Capitalization Milestone

In April 2025, Fidelity Bank’s market capitalization crossed the ₦1 trillion mark, elevating it into the league of Nigeria’s most valuable publicly listed banks. This milestone reflects increasing investor confidence and the bank’s rising prominence in the Nigerian capital market.

Prestigious Industry Recognition

Fidelity Bank was named “Nigeria’s Best Private Bank” at the 2025 Euromoney Awards, a global benchmark for excellence in banking. This accolade recognized the bank’s outstanding performance in wealth management, customer service, and tailored financial solutions for affluent clients.*Commitment to Dividend Policy*The bank reaffirmed its long-standing commitment to rewarding shareholders, maintaining a dividend payout ratio of 25%–40% of annual net profits. This policy ensures steady income for investors while preserving capital for future expansion and innovation.

Resilience Amid Legal Challenges

In a demonstration of legal and operational strength, Fidelity Bank successfully resolved a legacy of $3 million court judgment, clearing any reputational risks and financial uncertainties. This resolution underscores its commitment to transparency, governance, and financial integrity.

Business

The mischief in Fidelity Bank bankruptcy rumour – Ikechukwu Amaechi

Fidelity Bank Plc has dismissed as unfounded the story making the rounds that it is on the verge of bankruptcy following a Supreme Court judgment linked to a legacy $3 million credit facility granted by the defunct FSB International Bank in 2002.

The bank made the clarification on Monday, assuring the general public, depositors and stakeholders that it remains financially strong despite court judgment.

In a statement by its Divisional Head, Brand & Communications, Meksley Nwagboh, Fidelity Bank called for calm, stating that it was currently seeking judicial clarification on the accurate computation of the judgment sum.

“By way of a background, we confirm that the issues leading up to the judgment arose from a legacy transaction between the defunct FSB International Bank and Sagecom Concepts Limited,” the bank said.

According to the statement, FSB, a legacy bank taken over by Fidelity Bank, granted a credit facility to G. Cappa Plc in 2002 for the sum of $3 million. The facility was, in turn, secured with a mortgage on a property located in Ikoyi, Lagos.

However, when G. Cappa defaulted, the construction company quickly commenced legal proceedings against FSB at the Federal High Court, Lagos in a bid to prevent FSB from selling the mortgaged property to repay the loan.

Fidelity Bank’s press statement noted that the initial lawsuit was to restrain FSB from selling the property of the alleged loan defaulter.

The Federal High Court, in its judgment, ruled that the bank, as legal mortgagor, rightfully sold the leased interest in the property to Sagecom in 2011. The Court, however, declined to order vacant possession of the property and directed the issue to the Lagos State High Court.

In the meantime, G. Cappa remained in possession of the property and kept collecting rents.

Sagecom’s claim against the bank was essentially for liquidated damages. In 2018, the Lagos High Court awarded judgment in favour of Sagecom against G. Cappa even when it refused to order vacant possession of the property, a judgment which was challenged at the Supreme Court by Fidelity Bank for final adjudication.

But just like the High Court judgment, the Supreme Court ruled in favour of Sagecom.

Fidelity Bank said it was convinced that by remaining in possession of the property and continuing to collect rents, G. Cappa created the losses suffered by Sagecom.

However, the bank noted that after exhausting the appeal process, it is open to settling the obligation.

In fact, enquiries by TheNiche indicate that both Fidelity Bank and Sagecom are already in talks over how the judgment debt could be paid over a mutually agreed period.

It was this court ruling that detractors of the bank latched on in their demarketing voyage, which is what the bankruptcy story is all about.

And in debunking the bankruptcy insinuation, the bank assured depositors and investors of its safety as a going business concern, noting that it does not have solvency or liquidity problems.

The bank assured the public that, regardless of the Supreme Court judgment, Fidelity Bank was not under the threat of bankruptcy or liquidation.

But that fact is rather obvious. Fidelity Bank has consistently demonstrated strong financial performance, with significant growth in key financial metrics like profit before tax (PBT), gross earnings, and net interest income. The bank is also well-capitalized, maintaining a strong capital adequacy ratio (CAR) well above the minimum regulatory requirements, which is an indication of a robust financial foundation.

Not only that, it is also expanding its presence both within Nigeria and internationally, with a focus on digital banking and customer-centric services and the bank has received multiple awards, including for its performance in corporate banking, SMEs, and digital banking, highlighting its strength and leadership in the financial sector.

It is therefore not surprising that it has garnered very positive investor sentiment and consequential strong support, with oversubscription in equity capital raises and a high growth rate in share prices.

Not only that, the Central Bank of Nigeria (CBN) has weighed in on the matter, dismissing the bankruptcy story as misleading.

In a statement on Monday night, the apex bank and regulator said its attention had been drawn to some publications and social media reports containing “misleading information regarding the operations of a regulated financial institution.”

The statement by Mrs. Hakama Sidi Ali, Acting Director, Corporate Communications, affirmed that the CBN “continues to monitor all financial institutions under its regulatory purview and maintains robust frameworks for early warning signals and risk-based supervision. These mechanisms ensure that any emerging issues are promptly addressed to protect the integrity of the financial system.”

The CBN urged the public to “disregard sensational or unverified claims and rely solely on official channels for information about the financial system.”

The statement titled, “CBN reassures public on banking sector stability,” reads:

“The attention of the Central Bank of Nigeria (CBN) has been drawn to certain publications and social media reports containing misleading information regarding the operations of a regulated financial institution.

“The CBN wishes to categorically reassure the public, depositors, and stakeholders that the Nigerian banking sector remains resilient, safe, and sound. Like all other regulated institutions, the institution referenced in these reports is held to stringent regulatory requirements and there is no cause for concern regarding the safety of depositors’ funds.

“The Bank affirms that it continues to monitor all financial institutions under its regulatory purview and maintains robust frameworks for early warning signals and risk-based supervision. These mechanisms ensure that any emerging issues are promptly addressed to protect the integrity of the financial system.

“We urge the public to disregard sensational or unverified claims and rely solely on official channels for information about the financial system.

“The CBN remains dedicated to fostering a secure banking environment where depositors can be fully confident in the safety of their funds. It will continue to monitor and adapt strategies to safeguard the financial interests of all Nigerians and stakeholders in our financial system.”

Some financial experts who spoke to TheNiche insist that the bankruptcy story was contrived in the warped minds of those who are unable to compete and are “unnerved by the unprecedented growth of Fidelity Bank particularly under the leadership of Nneka Onyeali-Ikpe.”

How can a bank, which is unarguably one of Nigeria’s leading Tier-1 financial institutions, a bank that has just announced a remarkable financial performance for the first quarter of 2025, recording a PBT of N105.8 billion, which represents an impressive growth of 167.8 per cent compared to N39.5 billion in Q1 2024, suddenly go bust,” asks Mr. Olamilekan Johnson, a financial expert.

“It is all an attempt by unscrupulous people to demarket the bank. This is not the first and I am afraid, it won’t be the last. But I hope that in the interest of the country’s financial sector, they stop.”

Johnson is right. In the wake of the revocation the banking licence of Heritage Bank Plc by the CBN on June 3, 2024, the same malicious campaign, an odious attempt to precipitate a run on Fidelity Bank, was mounted by unscrupulous people, who insinuated then, as they are doing now, that Fidelity Bank, Wema Bank, Polaris Bank and Unity Bank – will go the Heritage way.

That was one week after the bank signed the necessary documentation to raise about N127.1 billion from a public offer and rights issue to its existing shareholders to raise its capital base in line with the CBN’s fresh capitalisation directive.

Could it also be that this bankruptcy hoax is the panic reaction of the same naysayers who cannot relate positively to the robust fundamentals exemplified in the incredible performance of the bank as captured in its financial statements released late last month?

The bank’s unaudited financial statements, which was released on the Nigerian Exchange (NGX) on April 30, 2025, showed a substantial increase in gross earnings, which rose to N315.4 billion, marking a year-on-year growth of 64.2 per cent from N192.1 billion in the same period last year.

Growth in interest income was primarily led by 38.6 per cent yoy (7.4 per cent ytd) expansion in earning assets base, while the increase in non-interest revenue came from FX-related income, trade and commission on banking services, etc., supported by increased customer transactions.

Commenting on the bank’s performance, Dr. Nneka Onyeali-Ikpe, the Managing Director/Chief Executive Officer, stated: “We started the year with triple-digit growth in profit and sustained the momentum in our earning assets growth. This performance shows the resilience of our business model and reinforces our confidence in delivering a better result in the 2025 financial year.”

Other areas of the unaudited financial statements equally showed a marked improvement with total deposits growing by 11.1 per cent ytd to N6.6 trillion from N5.9 trillion in December 2024, driven by 10.6 per cent ytd growth in low-cost deposits to N6.1 trillion, which represents 92.2 per cent of total customer deposits.

Local currency deposits increased by 2.0 per cent ytd while foreign currency deposits increased by 21.4 per cent from $1.9 billion in December 2024 to $2.3 billion.

“Beginning the year with such positive momentum reinforces our commitment to supporting the growth of individuals and businesses, while enhancing our financial sustainability. As we go into the rest of the year, we remain focused on building a resilient banking franchise with a diversified earnings base,” Onyeali-Ikpe added.

And that is exactly what Fidelity Bank is doing. Those who are purveying the bankruptcy story about Fidelity Bank Plc., a full-fledged commercial deposit money bank, serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited, and ranked among the best banks in the country are only engaged in wishful thinking with no evidence or even logic to hang their delusional assumption.

As published on thenicheng.com

Business

Fidelity Bank: Strong, Reliable, Built for the Future

Naijanewsngr– Fidelity Bank Plc continues to shine as a beacon of strength, reliability, and resilience in Nigeria’s dynamic banking industry.

With a track record of delivering outstanding performance and exceeding expectations, the bank has further cemented its place among the country’s most trusted financial institutions.

In its recently released Audited Financial Statements for the 2024 financial year, Fidelity Bank posted an extraordinary 210% growth in Profit Before Tax (PBT) to ₦385.2 billion, while Profit After Tax surged by 179.6% to ₦278.1 billion. These record-breaking numbers reflect not only impressive growth but a deep-rooted commitment to excellence, even in the face of economic headwinds.

This performance is no fluke. It is backed by deliberate strategy, solid capital structure, and prudent management.

Following its oversubscribed capital raise of ₦175.9 billion in 2024, Fidelity’s Capital Adequacy Ratio (CAR) now stands at a strong 23.5%, giving it more than enough headroom to continue supporting large-scale projects, expanding services, and delivering superior shareholder returns.

Its stock market capitalization has returned to over ₦1 trillion, driven by renewed investor confidence and a 141% share price growth over the past year.

What truly sets Fidelity Bank apart, however, is the solidity of its operations and the quality of service it delivers. From individuals and SMEs to large corporates and government institutions, customers are guaranteed safe, seamless, and efficient banking experiences across every touchpoint.

At the core of Fidelity’s operations is a robust digital banking infrastructure that continues to evolve to meet the needs of a modern, fast-paced economy. Its award-winning Fidelity Mobile App and internet banking platforms offer secure, user-friendly, and feature-rich solutions for customers on the go.

With innovations in real-time payments, digital lending, automated investment services, and 24/7 customer support, the bank is redefining convenience and pushing the boundaries of what banking should be.

This digital prowess was recognized with multiple awards in 2024, including “Most Innovative Mobile Banking Application” by Global Business Outlook and “Excellence in Digital Transformation” by BusinessDay BAFI Awards.

Fidelity Bank’s ability to adapt, innovate, and empower is equally evident in its commitment to the MSME sector, which remains the backbone of the Nigerian economy. Through strategic partnerships like the one with SMEDAN, the bank is driving inclusive growth by providing low-interest funding, capacity building, and market access to small businesses across Nigeria and beyond.

With over 9.1 million customers, 255 business offices, and a growing presence in the United Kingdom through FidBank UK Limited, Fidelity Bank is not just keeping pace—it is setting the pace.

As the bank continues to expand its services, scale up its technology, and deepen its market presence, one thing remains clear: Fidelity Bank is built on a solid foundation, powered by visionary leadership, and driven by a commitment to excellence.

In a world where trust, performance, and innovation are everything, Fidelity Bank is the institution that continues to stand tall, serve exceptionally, and soar higher—today, tomorrow, and into the future.

Business

WHO IS AFRAID OF FIDELITY BANK -By Udeme Etukeyen

Leading up to the recent superlative annual reports showcasing one of the most significant growth experienced by a Nigeria Financial Institution in recent years I was forced to ask “what is Fidelity Bank” doing right?

My banking and financial sector experience got me digging deeper into the statistics of the report-Fidelity Bank recorded a substantial 210.0% growth in PBT, reaching N385.2 billion in FY 2024. Deposits increased by 47.9%, from N4.0 trillion in 2023FY to N5.9 trillion in 2024FY, Gross earnings shooting by 87.7% to N1,043.4 billion which was primarily caused by a 106.9% increase in interest and similar income. Was I impressed? Absolutely 👍🏾

Now to the scary part, they opened the year with a bang implying that 2025 year end results was going to be nothing but spectacular; check this out-Fidelity reported a whooping 167.8% increase in PBT (Profit Before Tax)to N105.8 billion in Q1 2025, compared to N39.5 billion in Q1 2024. Gross earnings from January to April had reached some N315.421 billion signaling a 64.21% increase year-on-year.

These results were nothing short of astonishing and with great hope I sat my team to review our Investment Strategy to accommodate taking up equities in Fidelity and advising our portfolio investors to do same.

We quickly appraised the fundamentals and Key Success Factors to include their focus on the strategic youth economy that the Creative and Digital Transformation sector promises, the banks bullish inroads in MSME promotion and financing, their glowing penchant for Gender inclusion without abandoning the core sectors of Mining, Renewables and other key industries

Then came the dissecting of Leadership, my team of analysts mostly female went on about Fidelity MD being one of the most experienced and affable Amazons in the industry; done this, achieved that and all the entreaties you’d expect from smart ladies who feel mentored from a distance. I didn’t hesitate to draw their attention to the experience of the menfolk within the organization like I had any measurable data to establish that mix…truth remains you can’t but admire the Banks Leadership and strides

A deeper look at the banks expansion globally could reveal a strategic and noiseless acquisition of Union Bank,London and their planned incursion into African and other European financial markets, you just can see that such daring strides and impact would give competition and detractors sleepless nights. Not in an era where sleeping pills are sold strictly by prescription and no thanks to the high cost of medication for peddlers of cheap propaganda

Within barely 30days of announcing such magnificent results little wonder how pundits would cook or spin a narrative to suggest a bank that has announced herself as First Tier with shoulders leveled up with other Banking giants would shudder over a judgement against her customer G.Cappa or even the contribution they would be required to cough out over that said Sagecom saga. With that judgement not going the way of pundits a contemptuous attempt at calculating interest at unclassified rates from an initial N14b to cause an unnecessary scare or negative press on the bank speaks volumes of how we unrepentantly strive to destroy value in our economy.

One would think that interpretation of the judgment and computation of due figures which will understandably come with a payment plan be awaited instead of the usual bad blood generated and envisaged by toddler media characters.

It is not in doubt that the discerning public sees through the cruise and flat falling attempt of dramatic clout chasers ever ready to stain Fidelity’s white apparel which savvy Investors and analysts are filled with bridal admiration

Like Joseph Campbell hinted in his famous quote “The cave you fear to enter holds the treasure you seek.” We cast our treasures and bets on Fidelity Bank as the Nigerian treasure house to beat in the years ahead!

Udeme Etukeyen is an Abuja based Pan African Investment Advisory Expert

-

News3 years ago

News3 years agoWhat Led Us To Choose Peter Obi As Our Candidate?-Middlebelt Forum

-

Entertainment2 years ago

Entertainment2 years agoTaylor Swift Skips Travis Kelce’s Big Game to Prepare for ‘Eras Tour’

-

BREAKING NEWS2 years ago

BREAKING NEWS2 years agoKey Insights for the Upcoming 2023/2024 UEFA Champions League Campaign

-

News1 year ago

News1 year agoPaul Agbonze Obazele Addresses Labor Party Leaders in Edo Central Senatorial District

-

BREAKING NEWS2 years ago

BREAKING NEWS2 years agoVan Gaal Alleges 2022 World Cup Rigged in Favor of Messi and Argentina

-

BREAKING NEWS2 years ago

BREAKING NEWS2 years agoBarcelona Triumphs in Women’s Champions League Opener as Oshoala Shines Despite Saudi Visa Cancellation

-

News2 years ago

News2 years ago“New King of Serie A,” Tinubu hails Osimhen on winning the Serie A Title

-

Entertainment2 years ago

Entertainment2 years agoAdebola Williams and Kehinde: Welcoming Baby Arinoluwa