News

Aliko Dangote Foundation, WEF Announces 2024 Class of Dangote Fellows

Aliko Dangote Foundation, WEF Announces 2024 Class of Dangote Fellows

Aliko Dangote Foundation (ADF), in conjunction with the World Economic Forum (WEF) and Forum of Young Global Leaders (YGL), has unveiled gifted and high calibre individuals for the esteemed 2024 class of the World Economic Forum Young Global Leaders (YGL) Dangote Fellows.

ADF and WEF, in a release, said, “With great excitement and anticipation, ADF and WEF announce this year’s cohort, a group of visionary leaders poised to make impactful contributions to global development, innovation, and leadership.

The WEF YGL Dangote Fellowship, a partnership between the Aliko Dangote Foundation and the World Economic Forum, identifies, engages, and supports outstanding individuals under the age of 40 who demonstrate exceptional leadership potential in various fields.

This year’s class, according to ADF and WEF embodies the diverse talents, expertise, and commitment to positive change that characterise the YGL community.

The selected young leaders are: Alloysius Attah, Co-Founder & CEO of Farmerline, Ghana; Angela Oduor Lungati, Executive Director of Ushahidi Inc., Kenya; Judy Sikuza, CEO of the Mandela Rhodes Foundation, South Africa; Lelise Neme Sori, Commissioner at the Ethiopian Environmental Protection Authority, Ethiopia, and Nomasonto Motaung, Deputy Minister in the Presidency Government of South Africa, South Africa.

Others include: Oluwatosin Olaseinde, Founder & CEO of Money Africa, Nigeria; Veda Sunassee, CEO African Leadership University, Mauritius, and Thabile Ngwato, CEO & Co-Founder of Newzroom 405, South Africa.

A statement jointly released by ADF and WEF, indicated that “For the first time, the newly inducted Fellows will convene for a transformative three-day retreat in Geneva, Switzerland, organised by the World Economic Forum Foundation. The retreat aims to provide an unparalleled opportunity for the new class of Young Global Leaders to connect with their peers, deepen their understanding of the YGL community, and align themselves with its core values.

“This gathering underscore the commitment of the Forum of Young Global Leaders to foster collaboration, innovation, and sustainable leadership among the world’s most promising young change-makers.

“We are thrilled to welcome the exceptional individuals who make up the Class of 2024 Aliko Dangote Fellows,” said Fatima Aliko Dangote, Aliko Dangote Foundation Board Trustee member. “Their diverse backgrounds, bold ideas, and unwavering commitment to driving positive change will undoubtedly enrich our community and contribute to shaping a more inclusive and sustainable future for all.

“We believe that these remarkable individuals will not only benefit from the resources and opportunities provided by the WEF YGL Dangote Fellowship but will also leverage their talents and expertise to address some of the most pressing challenges facing our world today,” she added.

Young Global Leaders are selected from a variety of sectors such as business, government, academia, media, non-profit organisations and arts and culture, and from all regions of the world. Young Global Leaders engage in initiatives that address specific challenges of public interest with the objective of shaping a better future

The honour, bestowed each year by the Forum, recognises young leaders from around the world for their professional accomplishments, commitment to society and potential to contribute to shaping the future of the world.

The 2024 honourees will become part of the broader Forum of Young Global Leaders that convene at an Annual Summit, which are integrated into events organised by the World Economic Forum, and organise events of their own, as well as launch and lead their own innovative initiatives and task forces.

These activities enable YGLs to learn from and with each other; build knowledge and engender a better understanding of global challenges and trends, risks and opportunities; and further enhance their unique role as leaders within their own organisations, the World Economic Forum and the broader global community.

Past YGLs include: Uche Pedro, Founder & CEO Bella Online Media, Tokini Peterside, CEO Art X Collective, Oluseun Onigbinde, Co-founder BudgIT, Adebola Williams, CEO Red Media Africa, Dr. Tolu Oni, Associate Professor University of Cape Town & University of Cambridge

Others are: Iyinoluwa Aboyeji, (ex-)CEO Flutterwave (now CEO Fund for Africa’s Future), Lois Auta, Founder & ED Cedar Seed Foundation, Ada Osakwe, Managing Partner Agrolay Ventures, Cynthia Mosunmola Umoru, Founder Honeysuckles PTL Ventures, Simon Kolawole, Founder & CEO Cable Newspaper, Tara Fela-Durotoye, Founder & CEO House of Tara, among many others

Since its inception in 2011, the partnership between the Forum of Young Global Leaders and the Aliko Dangote Foundation has been instrumental in nurturing Africa’s next generation of leaders. Over the past decade, the Foundation’s support has empowered over 115 YGL Dangote Fellows, enabling them to accelerate their impact and catalyse lasting change across the continent and beyond.

The Aliko Dangote Foundation Fellows join a prestigious network of over 1,400 Young Global Leaders from diverse fields including business, government, academia, and civil society. Together, they represent a powerful force for driving positive change and addressing the world’s most pressing challenges.

The Forum of Young Global Leaders, established by the World Economic Forum in 2004, is a unique, multistakeholder community of more than 1,400 outstanding young leaders from around the world. Each year, the Forum recognises the most innovative, enterprising, and socially minded individuals under the age of 40 who are pushing the boundaries of global leadership and making a positive impact on society.

The Aliko Dangote Foundation, established by foremost Nigerian industrialist and humanist Aliko Dangote, is committed to improving the quality of life for people across Africa by supporting initiatives in health and nutrition, education, and economic empowerment.

The World Economic Forum is the International Organisation for Public-Private Cooperation. The Forum engages the foremost political, business, cultural, and other leaders of society to shape global, regional, and industry agendas.

Entertainment

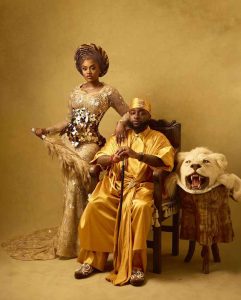

#CHIVIDO24: See Loved Up Photos From Davido and Chioma’s Pre-wedding Photoshoot

Naijanewsngr reports that Davido and Chioma have released their pre-wedding snapshots and videos, asserting that their wedding, which is scheduled for the 25th of June, 2024, is OFFICIAL.

Fans have tagged the wedding to be the final bus stop for a love that stood the test of time. They have asserted that the four year wait after the release of Davido’s song 1 Milli where he featured his now Fiance, has been worth it.

See pictures and Videos from the Pre-wedding photoshoot;

More wedding updates loading…

AREN’T THEY BEAUTIFUL!!

News

Dangote Refinery to set up terminal in the Caribbean for export of petroleum products

Dangote Refinery to set up terminal in the Caribbean for export of petroleum products

Dangote Refinery is planning to set up a terminal in the Caribbean to export petroleum products to countries in the North American region.

Aliko Dangote, the president and CEO of the refinery, made this disclosure on Wednesday at Afreximbank’s Trade and Investment Forum in The Bahamas.

The business mogul said the company can easily supply petroleum products to the region within 18 to 20 days.

According to Africa’s richest man, the company will sign a bilateral agreement with the region to construct the terminal for the exportation of its petroleum products.

“I know the price in the Caribbean in terms of petroleum products is very high. We produce it cheaply. We can always bring it here. We can set up a terminal and we’ll be able to fix their needs.

“We will have a bilateral agreement with them and also bringing in stuff from there is not more than 18 to 20 days maximum. And then we need to set up a terminal.

“Once we set up a terminal, they will have a very cheap oil. They will have cheap energy. And by having cheap energy, their own economy will grow faster,” Dangote said.

Dangote to also export Cement to the Region

In addition, the CEO of the $20 billion refinery mentioned that the conglomerate is not only seeking to invest in petroleum products in the region but also in cement.

Dangote stated that the company’s cement production capacity is nearly 52 million tons and will increase to about 62 million tons by the end of next year.

He added that the firm can meet the demand of the Caribbean market, creating a win-win situation for both parties.

“It’s not only about the oil. We now have a capacity of almost 52 million cement capacity. By the end of next year, we will be at 62 million of cement capacity. We are not only saying that we can bring in from Nigeria or from Africa.

“If they have limestones, we can also produce what can satisfy them. We’ve done that before in Africa and we should be able to free them up from the shackles of other people.

“If we the ingredients like the limestones etc, it’s a 28 months maximum. They can all be self-sufficient. It will be a win-win between us and them,” Dangote said.

What you should know

The Dangote refinery with a 650,000 barrel refining capacity has been described as the “game changer” of the oil and gas sector.

The refinery will be the largest in Africa and Europe once it begins full operation later next year.

According to reports, the $20 billion petroleum facility is expected to disrupt the $17 billion Africa-European market and reduce the continent’s dependence on imported petroleum products from Europe.

In addition, Dangote stated that the company is also eyeing the Brazilian market and other North American countries to supply refined products from the refinery.

“Our capacity is too big for Nigeria. It will be able to supply West Africa, Central Africa and also Southern Africa,” Dangote said in a panel discussion in Rwanda a few weeks ago.

News

Dangote Refinery Mulls Lagos, London Stock Exchange Listings

Dangote Refinery Mulls Lagos, London Stock Exchange Listings

The Dangote refinery is aiming for a dual listing on the London and Lagos bourses, a senior executive at the firm, Devakumar Edwin, has told Reuters.

Africa’s richest man and Chairman of the group, Aliko Dangote was earlier on Tuesday, quoted as saying he could try to list the company in Nigeria by the end of the year.

It is coming about six months after Dangote, also told the Financial Times of his intentions to publicly list the subsidiary of the Group, Dangote Petroleum Refinery on the Nigerian Exchange Limited.

At the time, Dangote stated that the company had resolved challenges about crude oil supply and was prepared for the listing.

The billionaire businessman already has some companies listed on the NGX, including Dangote Cement, Dangote Sugar Refinery and Nascon Allied Industries.

The refinery managers said there was need to approach the London Exchange because the Nigerian bourse may not have the capacity to handle it exclusively.

Asked to comment on Dangote’s statement to local media, Edwin told Reuters: “We have listed all our businesses. The NSE (Nigerian Stock Exchange) will not have adequate depth to handle exclusively the petroleum refinery. We would have to take it to LSE (London Stock Exchange) but also list in NSE.”

The refinery, Africa’s largest, built on a peninsula on the outskirts of the commercial capital Lagos at a cost of $20 billion, was completed after several years of delay.

It can refine up to 650,000 barrels per day (bpd) and will be the largest in Africa and Europe when it reaches full capacity this year or next.

Dangote has been trying to secure crude supplies for his refinery. He has interests in Dangote Cement, Dangote Flour Mills and Dangote Sugar, all listed on the Nigerian bourse.

In May, the company reached its first supply deal with TotalEnergies, after it put out a tender for 2 million barrels of West Texas Intermediate (WTI) Midland crude every month for a year starting in July, according to tender documents.

The company since earlier in the year, has been refining diesel, jet fuel and other petroleum products and is expected to begin the production of petrol in June.

Meanwhile, the Nigerian National Petroleum Company Limited (NNPC) has said it recorded 310 cases of crude oil theft in the past week.

In its weekly update on the activities of the national oil company, the NNPC said that the cases were discovered between May 18 and May 24.

“Between May 18 and 24, 310 cases were recorded across the Niger Delta region by several incidence sources,” the NNPC stated.

In Grey Creek, Akwa Ibom state, it said a fuel station selling illegally refined fuels into cans and drums was uncovered in the past week, revealing that 122 illegal refineries were also uncovered in Bayelsa and Rivers states

According to the company, they were spotted in Tombia II, III, IV, and Umuajuloke, in Rivers state; Iduwini, Biogbolo, and Ajatiton, in Bayelsa state, while 65 illegal connections were discovered across several locations in Akuwa Odoka, Umuajuloke, and Watson Point, also in Rivers state as well as along Soku Sand Barth pipeline in the state.

It added that vandalised wellheads were discovered in Tombia IIII in Rivers state and Egbema in Imo state, where a pit filled with crude oil from a vandalised wellhead was discovered.

In Ndoni, Rivers state, NNPC said it uncovered a vandalised pipeline channelled to a nearby oil pit, while five illegal storage sites were spotted in sacks, pits, cans, and in a fuel station.

The NNPC stated that 20 vehicle arrests were made in Delta and Imo states while 48 infractions were reported at sea. Also, 39 wooden boats conveying stolen crude or illegally refined products were seized and confiscated across several creeks in Bayelsa and Delta states, it said.

NNPC said 48 of the incidents occurred in the deep blue water, 40 in the western region, 134 in the central region, and 88 in the eastern region.

-

News2 years ago

News2 years agoWhat Led Us To Choose Peter Obi As Our Candidate?-Middlebelt Forum

-

BREAKING NEWS10 months ago

BREAKING NEWS10 months agoKey Insights for the Upcoming 2023/2024 UEFA Champions League Campaign

-

Entertainment9 months ago

Entertainment9 months agoTaylor Swift Skips Travis Kelce’s Big Game to Prepare for ‘Eras Tour’

-

News6 months ago

News6 months agoPaul Agbonze Obazele Addresses Labor Party Leaders in Edo Central Senatorial District

-

BREAKING NEWS11 months ago

BREAKING NEWS11 months agoVan Gaal Alleges 2022 World Cup Rigged in Favor of Messi and Argentina

-

News1 year ago

News1 year ago“New King of Serie A,” Tinubu hails Osimhen on winning the Serie A Title

-

BREAKING NEWS12 months ago

BREAKING NEWS12 months agoBayern Munich Engages in Discussions for the Acquisition of David De Gea from Manchester United

-

News2 years ago

News2 years agoHappy 62nd Anniversary of Nigeria’s Independence!