News

Management of Abuja Disco was fired due to inadequate power supply.

Management of Abuja Disco was fired due to inadequate power supply.

A major management shakeup yesterday hit the Abuja Electricity Distribution Company (AEDC), as the embattled electricity firm named Victor Ojelabi as its acting managing director and CEO. Until yesterday, Ojelabi was the firm’s chief internal auditor.

The appointment also means the new MD becomes the sixth Chief Executive of the Disco in the last 10 years. Those before him were Neil Croucher, Ernest Mupwaya, Akinwumi Bada, Engr. Adeoye Fadeyibi, and Chris Ezeafulukwe.

For the embattled Disco, the shake-up is not unconnected with moves by its major investor, the Transcorp Group led by Tony Elumelu, to reposition the troubled AEDC. Recall that in May 2023, the national council on privatisation approved the Transcorp-led consortium as the preferred bidder for AEDC after acquiring a 60 percent stake in the troubled Disco.

Prior to the Transcorp takeover, AEDC, which was granted a license in 2013, has had its fair share of challenges, especially in the areas of financial management, a dearth of governance structure, the sector’s risk volatility, and regulatory risk exposures.

In December 2021, the United Bank for Africa (UBA) took over the Disco over the inability of its then major stakeholder, Kann Consortium, to service the $122 million loan it took in 2013 to acquire the AEDC.

By April 2023, that is, 10 years later, the bank had moved to recover its loan facility from the firm. And by May 2023, the Transcorp-led consortium had bought over 60 percent of the Disco.

Besides, the company was faced with challenges of management, improving customer relations, data centricity, revenue optimization, collection efficiencies, billing efficiencies, and reducing to the barest possible point the ATC and C losses, amongst others. AEDC has also recently experienced dwindling fortunes in revenue and cash flow, and it has become difficult to meet most of its financial obligations to some service providers and contractors.

The new appointment was contained in a memo signed by the Chairman, Board of Directors, AEDC, Dr. Stanley Lawson, and addressed to all staff of the company. “Victor has been charged with driving the board-approved turnaround plan to reposition AEDC as the leading distribution company in Nigeria,” the memo stated.

A very top source close to the Transcorp Group told The Nation that the appointment is “a move geared at repositioning the AEDC and for the Group to now stamp its foot on the ground with the aim of overhauling and fully repositioning the Disco.”

“It has taken over seven months since our group bought the majority stake in Disco; now we are set to reposition the firm and make progress after carrying out due diligence and putting the necessary things in place,” the top source said.

Perhaps corroborating the source, a statement credited to the acting managing director and the chief executive officer of AEDC described the development as a major realignment for effectiveness.

“In furtherance of the implementation of the Board-approved AEDC Turnaround Plan, please be advised of the following key updates in our dear company as we move to reposition AEDC as the clear market leader in Nigerian electricity distribution. Chief Technical Officer, Godfrey Aba; Chief Business Officer (CBO), Leticia Ejendu; Head, Human Resources, Ibem Idika; Chief Internal Auditor, Irene Nwankwo.” Other officers were also appointed in acting capacities.

Entertainment

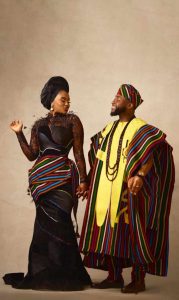

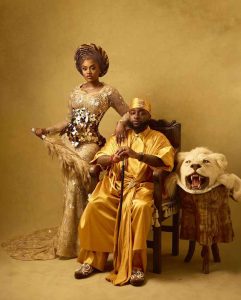

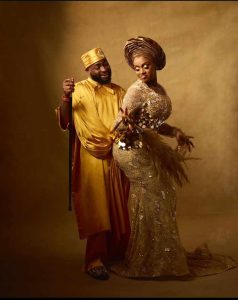

#CHIVIDO24: See Loved Up Photos From Davido and Chioma’s Pre-wedding Photoshoot

Naijanewsngr reports that Davido and Chioma have released their pre-wedding snapshots and videos, asserting that their wedding, which is scheduled for the 25th of June, 2024, is OFFICIAL.

Fans have tagged the wedding to be the final bus stop for a love that stood the test of time. They have asserted that the four year wait after the release of Davido’s song 1 Milli where he featured his now Fiance, has been worth it.

See pictures and Videos from the Pre-wedding photoshoot;

More wedding updates loading…

AREN’T THEY BEAUTIFUL!!

News

Dangote Refinery to set up terminal in the Caribbean for export of petroleum products

Dangote Refinery to set up terminal in the Caribbean for export of petroleum products

Dangote Refinery is planning to set up a terminal in the Caribbean to export petroleum products to countries in the North American region.

Aliko Dangote, the president and CEO of the refinery, made this disclosure on Wednesday at Afreximbank’s Trade and Investment Forum in The Bahamas.

The business mogul said the company can easily supply petroleum products to the region within 18 to 20 days.

According to Africa’s richest man, the company will sign a bilateral agreement with the region to construct the terminal for the exportation of its petroleum products.

“I know the price in the Caribbean in terms of petroleum products is very high. We produce it cheaply. We can always bring it here. We can set up a terminal and we’ll be able to fix their needs.

“We will have a bilateral agreement with them and also bringing in stuff from there is not more than 18 to 20 days maximum. And then we need to set up a terminal.

“Once we set up a terminal, they will have a very cheap oil. They will have cheap energy. And by having cheap energy, their own economy will grow faster,” Dangote said.

Dangote to also export Cement to the Region

In addition, the CEO of the $20 billion refinery mentioned that the conglomerate is not only seeking to invest in petroleum products in the region but also in cement.

Dangote stated that the company’s cement production capacity is nearly 52 million tons and will increase to about 62 million tons by the end of next year.

He added that the firm can meet the demand of the Caribbean market, creating a win-win situation for both parties.

“It’s not only about the oil. We now have a capacity of almost 52 million cement capacity. By the end of next year, we will be at 62 million of cement capacity. We are not only saying that we can bring in from Nigeria or from Africa.

“If they have limestones, we can also produce what can satisfy them. We’ve done that before in Africa and we should be able to free them up from the shackles of other people.

“If we the ingredients like the limestones etc, it’s a 28 months maximum. They can all be self-sufficient. It will be a win-win between us and them,” Dangote said.

What you should know

The Dangote refinery with a 650,000 barrel refining capacity has been described as the “game changer” of the oil and gas sector.

The refinery will be the largest in Africa and Europe once it begins full operation later next year.

According to reports, the $20 billion petroleum facility is expected to disrupt the $17 billion Africa-European market and reduce the continent’s dependence on imported petroleum products from Europe.

In addition, Dangote stated that the company is also eyeing the Brazilian market and other North American countries to supply refined products from the refinery.

“Our capacity is too big for Nigeria. It will be able to supply West Africa, Central Africa and also Southern Africa,” Dangote said in a panel discussion in Rwanda a few weeks ago.

News

Dangote Refinery Mulls Lagos, London Stock Exchange Listings

Dangote Refinery Mulls Lagos, London Stock Exchange Listings

The Dangote refinery is aiming for a dual listing on the London and Lagos bourses, a senior executive at the firm, Devakumar Edwin, has told Reuters.

Africa’s richest man and Chairman of the group, Aliko Dangote was earlier on Tuesday, quoted as saying he could try to list the company in Nigeria by the end of the year.

It is coming about six months after Dangote, also told the Financial Times of his intentions to publicly list the subsidiary of the Group, Dangote Petroleum Refinery on the Nigerian Exchange Limited.

At the time, Dangote stated that the company had resolved challenges about crude oil supply and was prepared for the listing.

The billionaire businessman already has some companies listed on the NGX, including Dangote Cement, Dangote Sugar Refinery and Nascon Allied Industries.

The refinery managers said there was need to approach the London Exchange because the Nigerian bourse may not have the capacity to handle it exclusively.

Asked to comment on Dangote’s statement to local media, Edwin told Reuters: “We have listed all our businesses. The NSE (Nigerian Stock Exchange) will not have adequate depth to handle exclusively the petroleum refinery. We would have to take it to LSE (London Stock Exchange) but also list in NSE.”

The refinery, Africa’s largest, built on a peninsula on the outskirts of the commercial capital Lagos at a cost of $20 billion, was completed after several years of delay.

It can refine up to 650,000 barrels per day (bpd) and will be the largest in Africa and Europe when it reaches full capacity this year or next.

Dangote has been trying to secure crude supplies for his refinery. He has interests in Dangote Cement, Dangote Flour Mills and Dangote Sugar, all listed on the Nigerian bourse.

In May, the company reached its first supply deal with TotalEnergies, after it put out a tender for 2 million barrels of West Texas Intermediate (WTI) Midland crude every month for a year starting in July, according to tender documents.

The company since earlier in the year, has been refining diesel, jet fuel and other petroleum products and is expected to begin the production of petrol in June.

Meanwhile, the Nigerian National Petroleum Company Limited (NNPC) has said it recorded 310 cases of crude oil theft in the past week.

In its weekly update on the activities of the national oil company, the NNPC said that the cases were discovered between May 18 and May 24.

“Between May 18 and 24, 310 cases were recorded across the Niger Delta region by several incidence sources,” the NNPC stated.

In Grey Creek, Akwa Ibom state, it said a fuel station selling illegally refined fuels into cans and drums was uncovered in the past week, revealing that 122 illegal refineries were also uncovered in Bayelsa and Rivers states

According to the company, they were spotted in Tombia II, III, IV, and Umuajuloke, in Rivers state; Iduwini, Biogbolo, and Ajatiton, in Bayelsa state, while 65 illegal connections were discovered across several locations in Akuwa Odoka, Umuajuloke, and Watson Point, also in Rivers state as well as along Soku Sand Barth pipeline in the state.

It added that vandalised wellheads were discovered in Tombia IIII in Rivers state and Egbema in Imo state, where a pit filled with crude oil from a vandalised wellhead was discovered.

In Ndoni, Rivers state, NNPC said it uncovered a vandalised pipeline channelled to a nearby oil pit, while five illegal storage sites were spotted in sacks, pits, cans, and in a fuel station.

The NNPC stated that 20 vehicle arrests were made in Delta and Imo states while 48 infractions were reported at sea. Also, 39 wooden boats conveying stolen crude or illegally refined products were seized and confiscated across several creeks in Bayelsa and Delta states, it said.

NNPC said 48 of the incidents occurred in the deep blue water, 40 in the western region, 134 in the central region, and 88 in the eastern region.

-

News2 years ago

News2 years agoWhat Led Us To Choose Peter Obi As Our Candidate?-Middlebelt Forum

-

BREAKING NEWS10 months ago

BREAKING NEWS10 months agoKey Insights for the Upcoming 2023/2024 UEFA Champions League Campaign

-

Entertainment9 months ago

Entertainment9 months agoTaylor Swift Skips Travis Kelce’s Big Game to Prepare for ‘Eras Tour’

-

News6 months ago

News6 months agoPaul Agbonze Obazele Addresses Labor Party Leaders in Edo Central Senatorial District

-

BREAKING NEWS11 months ago

BREAKING NEWS11 months agoVan Gaal Alleges 2022 World Cup Rigged in Favor of Messi and Argentina

-

News1 year ago

News1 year ago“New King of Serie A,” Tinubu hails Osimhen on winning the Serie A Title

-

BREAKING NEWS12 months ago

BREAKING NEWS12 months agoBayern Munich Engages in Discussions for the Acquisition of David De Gea from Manchester United

-

News2 years ago

News2 years agoHappy 62nd Anniversary of Nigeria’s Independence!