News

IWD: Speakers at Polaris Bank Webinar Advocate for Women Empowerment In The Workplace

Naijanewsngr reports that a call has gone to organizations operating across all sectors in the country to create opportunities that empower women to fulfill their full potential for the good of society.

The call was made by CEO of Digital Jewels, Adedoyin Odunfa while speaking as a Guest Speaker at the Webinar organized by Polaris Bank Limited themed: Advancing Women Empowerment through the Adoption of Technological Innovation and Digital Education to mark the 2023 International Women’s Day which held in Lagos last week.

Focusing on the IWD 2023 theme: #EmbraceEquity, Odunfa while addressing gender imbalance in the workplace, cited statistics that show that women make up only 46 percent of the workplace and less than 25 percent of them end up in leadership positions.

She pointed out the need to address gender imbalance and prevailing conscious and unconscious biases against women. She also emphasized the need to intentionally empower women with technological innovation rather than just pay lip service to it.

According to Odunfa, one of the ways to create these opportunities is to have more women in the workplace to develop products and services that empower women. She also highlighted the need to intentionally target women for instance, in the design of financial services and products to make them more accessible, affordable, and relevant.

To achieve this, Odunfa called for improved financial literacy and investment in education, as well as training for gender parity in the workplace and marketplace. This sentiment was echoed by two other Panelists at the webinar: Chinyelu Chikwendu, a Director with Vatebra TechHub and Ededayo Durosinmi-Etti, CEO of Herconomy.

Also contributing at the session as a Panelist, Dr. (Mrs.) Amina Sambo-Magaji, an AI specialist, Researcher and Tech policy maker, emphasized the need for collaboration and a system approach to promote gender equality in the digital space.

Dr. Sambo-Magaji, a distinguished Humphrey Fellow, who doubles as a Director at National Information Technology Development Agency (NITDA) also called for measures to promote women’s participation in all aspects of digital, including technological innovation, and digital governance. She emphasized the need for policies that actively promote gender equality and empower women to be partners, consumers, and creators of technology and innovation.

Earlier, Polaris Bank’s Group Head, Customer Experience Management & Sustainability, Bukola Oluyadi spoke on why the Bank organised the Webinar. “The goal of this event is to address the various challenges faced by Women in diverse professions, identify skill gaps needed to be addressed, and how technology, innovation, and digital education can be leveraged to empower the woman so that Gender equity can be felt more in our economy.”

According to Oluyadi;

“Polaris Bank is committed to Women Empowerment, and consciously raising awareness on gender equity and ensure that no woman is financially excluded, or is disadvantaged in any way.

In her words;

“Only 30 percent of commercial banks in Nigeria have over 30 percent female representation on their board and Polaris Bank is one of such banks.

The Bank is also supporting women-led businesses with single-digit interest loans in celebrating IWD 2023 and women’s month. The Bank is also driving women empowerment internally by inaugurating its Women’s Network this month”, she disclosed.

Polaris Bank is a future-determining Bank redefining banking products and services that meet the needs of individuals and businesses. The Bank was adjudged Digital Bank of the Year in 2021 and 2022.

Entertainment

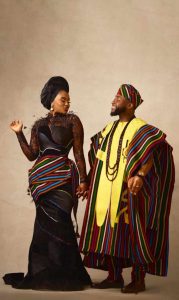

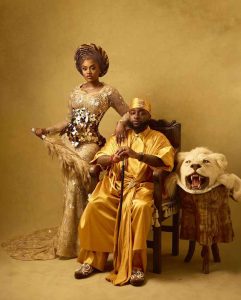

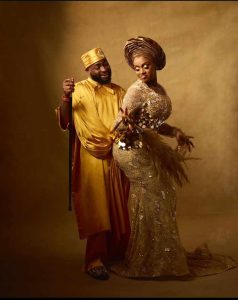

#CHIVIDO24: See Loved Up Photos From Davido and Chioma’s Pre-wedding Photoshoot

Naijanewsngr reports that Davido and Chioma have released their pre-wedding snapshots and videos, asserting that their wedding, which is scheduled for the 25th of June, 2024, is OFFICIAL.

Fans have tagged the wedding to be the final bus stop for a love that stood the test of time. They have asserted that the four year wait after the release of Davido’s song 1 Milli where he featured his now Fiance, has been worth it.

See pictures and Videos from the Pre-wedding photoshoot;

More wedding updates loading…

AREN’T THEY BEAUTIFUL!!

News

Dangote Refinery to set up terminal in the Caribbean for export of petroleum products

Dangote Refinery to set up terminal in the Caribbean for export of petroleum products

Dangote Refinery is planning to set up a terminal in the Caribbean to export petroleum products to countries in the North American region.

Aliko Dangote, the president and CEO of the refinery, made this disclosure on Wednesday at Afreximbank’s Trade and Investment Forum in The Bahamas.

The business mogul said the company can easily supply petroleum products to the region within 18 to 20 days.

According to Africa’s richest man, the company will sign a bilateral agreement with the region to construct the terminal for the exportation of its petroleum products.

“I know the price in the Caribbean in terms of petroleum products is very high. We produce it cheaply. We can always bring it here. We can set up a terminal and we’ll be able to fix their needs.

“We will have a bilateral agreement with them and also bringing in stuff from there is not more than 18 to 20 days maximum. And then we need to set up a terminal.

“Once we set up a terminal, they will have a very cheap oil. They will have cheap energy. And by having cheap energy, their own economy will grow faster,” Dangote said.

Dangote to also export Cement to the Region

In addition, the CEO of the $20 billion refinery mentioned that the conglomerate is not only seeking to invest in petroleum products in the region but also in cement.

Dangote stated that the company’s cement production capacity is nearly 52 million tons and will increase to about 62 million tons by the end of next year.

He added that the firm can meet the demand of the Caribbean market, creating a win-win situation for both parties.

“It’s not only about the oil. We now have a capacity of almost 52 million cement capacity. By the end of next year, we will be at 62 million of cement capacity. We are not only saying that we can bring in from Nigeria or from Africa.

“If they have limestones, we can also produce what can satisfy them. We’ve done that before in Africa and we should be able to free them up from the shackles of other people.

“If we the ingredients like the limestones etc, it’s a 28 months maximum. They can all be self-sufficient. It will be a win-win between us and them,” Dangote said.

What you should know

The Dangote refinery with a 650,000 barrel refining capacity has been described as the “game changer” of the oil and gas sector.

The refinery will be the largest in Africa and Europe once it begins full operation later next year.

According to reports, the $20 billion petroleum facility is expected to disrupt the $17 billion Africa-European market and reduce the continent’s dependence on imported petroleum products from Europe.

In addition, Dangote stated that the company is also eyeing the Brazilian market and other North American countries to supply refined products from the refinery.

“Our capacity is too big for Nigeria. It will be able to supply West Africa, Central Africa and also Southern Africa,” Dangote said in a panel discussion in Rwanda a few weeks ago.

News

Dangote Refinery Mulls Lagos, London Stock Exchange Listings

Dangote Refinery Mulls Lagos, London Stock Exchange Listings

The Dangote refinery is aiming for a dual listing on the London and Lagos bourses, a senior executive at the firm, Devakumar Edwin, has told Reuters.

Africa’s richest man and Chairman of the group, Aliko Dangote was earlier on Tuesday, quoted as saying he could try to list the company in Nigeria by the end of the year.

It is coming about six months after Dangote, also told the Financial Times of his intentions to publicly list the subsidiary of the Group, Dangote Petroleum Refinery on the Nigerian Exchange Limited.

At the time, Dangote stated that the company had resolved challenges about crude oil supply and was prepared for the listing.

The billionaire businessman already has some companies listed on the NGX, including Dangote Cement, Dangote Sugar Refinery and Nascon Allied Industries.

The refinery managers said there was need to approach the London Exchange because the Nigerian bourse may not have the capacity to handle it exclusively.

Asked to comment on Dangote’s statement to local media, Edwin told Reuters: “We have listed all our businesses. The NSE (Nigerian Stock Exchange) will not have adequate depth to handle exclusively the petroleum refinery. We would have to take it to LSE (London Stock Exchange) but also list in NSE.”

The refinery, Africa’s largest, built on a peninsula on the outskirts of the commercial capital Lagos at a cost of $20 billion, was completed after several years of delay.

It can refine up to 650,000 barrels per day (bpd) and will be the largest in Africa and Europe when it reaches full capacity this year or next.

Dangote has been trying to secure crude supplies for his refinery. He has interests in Dangote Cement, Dangote Flour Mills and Dangote Sugar, all listed on the Nigerian bourse.

In May, the company reached its first supply deal with TotalEnergies, after it put out a tender for 2 million barrels of West Texas Intermediate (WTI) Midland crude every month for a year starting in July, according to tender documents.

The company since earlier in the year, has been refining diesel, jet fuel and other petroleum products and is expected to begin the production of petrol in June.

Meanwhile, the Nigerian National Petroleum Company Limited (NNPC) has said it recorded 310 cases of crude oil theft in the past week.

In its weekly update on the activities of the national oil company, the NNPC said that the cases were discovered between May 18 and May 24.

“Between May 18 and 24, 310 cases were recorded across the Niger Delta region by several incidence sources,” the NNPC stated.

In Grey Creek, Akwa Ibom state, it said a fuel station selling illegally refined fuels into cans and drums was uncovered in the past week, revealing that 122 illegal refineries were also uncovered in Bayelsa and Rivers states

According to the company, they were spotted in Tombia II, III, IV, and Umuajuloke, in Rivers state; Iduwini, Biogbolo, and Ajatiton, in Bayelsa state, while 65 illegal connections were discovered across several locations in Akuwa Odoka, Umuajuloke, and Watson Point, also in Rivers state as well as along Soku Sand Barth pipeline in the state.

It added that vandalised wellheads were discovered in Tombia IIII in Rivers state and Egbema in Imo state, where a pit filled with crude oil from a vandalised wellhead was discovered.

In Ndoni, Rivers state, NNPC said it uncovered a vandalised pipeline channelled to a nearby oil pit, while five illegal storage sites were spotted in sacks, pits, cans, and in a fuel station.

The NNPC stated that 20 vehicle arrests were made in Delta and Imo states while 48 infractions were reported at sea. Also, 39 wooden boats conveying stolen crude or illegally refined products were seized and confiscated across several creeks in Bayelsa and Delta states, it said.

NNPC said 48 of the incidents occurred in the deep blue water, 40 in the western region, 134 in the central region, and 88 in the eastern region.

-

News2 years ago

News2 years agoWhat Led Us To Choose Peter Obi As Our Candidate?-Middlebelt Forum

-

BREAKING NEWS10 months ago

BREAKING NEWS10 months agoKey Insights for the Upcoming 2023/2024 UEFA Champions League Campaign

-

Entertainment9 months ago

Entertainment9 months agoTaylor Swift Skips Travis Kelce’s Big Game to Prepare for ‘Eras Tour’

-

News6 months ago

News6 months agoPaul Agbonze Obazele Addresses Labor Party Leaders in Edo Central Senatorial District

-

BREAKING NEWS11 months ago

BREAKING NEWS11 months agoVan Gaal Alleges 2022 World Cup Rigged in Favor of Messi and Argentina

-

News1 year ago

News1 year ago“New King of Serie A,” Tinubu hails Osimhen on winning the Serie A Title

-

BREAKING NEWS12 months ago

BREAKING NEWS12 months agoBayern Munich Engages in Discussions for the Acquisition of David De Gea from Manchester United

-

News2 years ago

News2 years agoHappy 62nd Anniversary of Nigeria’s Independence!